Most people don’t realize how much their prescription costs depend on something they’ve never heard of: insurance formulary tiers. It’s not just about whether your drug is covered-it’s about which tier it’s in. And that one detail can mean the difference between paying $10 or $200 for the same pill.

What Is a Formulary, Anyway?

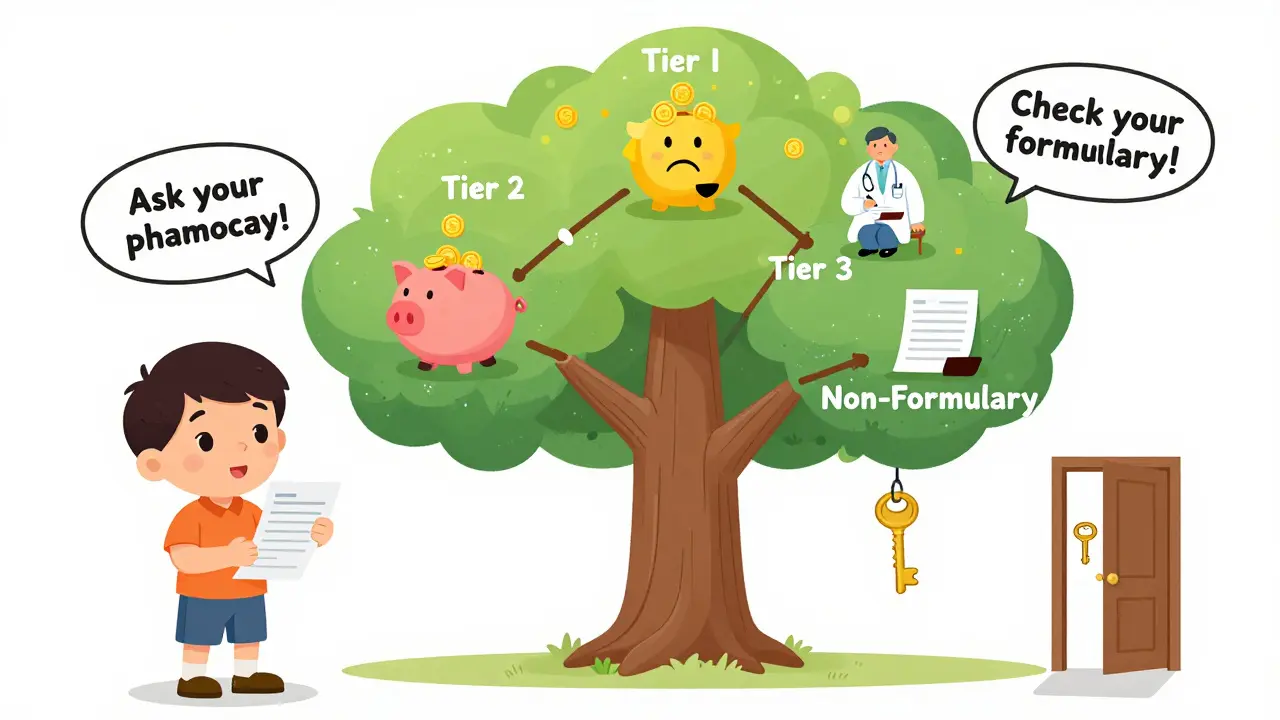

A formulary is simply the list of prescription drugs your health plan agrees to cover. But it’s not just a simple checklist. It’s broken into tiers-like levels in a game-each with its own price tag. The goal? To nudge you toward cheaper, equally effective drugs while still giving you access to what you need. Most plans use three to five tiers. Some use two. A few even have special tiers for expensive specialty drugs. The exact structure depends on your insurer, but the basic logic is the same: lower tiers = lower cost. Higher tiers = higher cost. And then there’s the last level: non-formulary, where your drug isn’t covered at all.Tier 1: The Cheap and Common

Tier 1 is where you want to be. This tier is almost always filled with generic drugs. These are copies of brand-name medications that have lost their patent protection. They work the same way. They’re just cheaper. In most commercial plans, Tier 1 copays range from $0 to $15 for a 30-day supply. For Medicare Part D beneficiaries, it’s often $0 or $5. That’s right-you might pay nothing. Insurers love Tier 1 because generics cost 80-90% less than brand names. And since they’re just as effective, there’s no reason not to use them. Examples: Metformin for diabetes, Lisinopril for high blood pressure, Atorvastatin for cholesterol. These are the workhorses of medicine. If your doctor prescribes one of these, you’re in the sweet spot.Tier 2: The Preferred Brands

Tier 2 is where you find brand-name drugs that your plan has chosen to favor. These aren’t generics. They’re the original versions made by the company that invented them. But they’re still considered cost-effective enough to be included at a lower price than other brands. Copays here typically run $20 to $40 for a 30-day supply in commercial plans. Medicare Part D calls this the “medium copayment” tier. Why are these drugs in Tier 2? Usually because the manufacturer gave the insurer a big discount-or rebate-to get them placed here. Examples: Brand-name versions of blood pressure or antidepressant drugs that still have no generic available. Or generics that are slightly more expensive than the cheapest option, but still considered a good value. Here’s the catch: Just because a drug is in Tier 2 doesn’t mean it’s the cheapest option. Sometimes a generic exists, but your plan didn’t put it in Tier 1. That’s why you need to check the formulary list before filling a prescription.Tier 3: The Expensive Brands

Tier 3 is where things start to hurt. These are brand-name drugs that your plan doesn’t prefer. Maybe there’s a cheaper alternative out there. Maybe the manufacturer didn’t offer a good enough rebate. Or maybe the drug is newer and hasn’t been tested for cost-effectiveness yet. Copays for Tier 3 drugs? Usually $50 to $100. Some plans charge even more. For Medicare Part D, this is labeled the “higher copayment” tier. These are the drugs that make people skip doses or switch to cheaper ones-even if it’s not ideal. Examples: Newer diabetes medications like Ozempic (semaglutide) or newer antidepressants that have no generic version yet. Or drugs like Singulair (montelukast), which still has brand-name pricing despite being widely used. If you’re on a Tier 3 drug and it’s essential, you might be able to get it moved down. Your doctor can file a formulary exception. That’s a formal request asking the insurer to cover it at a lower tier because there’s no safe or effective alternative. About 40% of these requests are approved, according to the Medicare Rights Center.

Tier 4 and 5: The Specialty Drugs

Not all plans have these, but most employer-sponsored and Medicare Part D plans do. These are for high-cost, complex medications-often used for cancer, autoimmune diseases, or rare conditions. These aren’t pills you pick up at your local pharmacy. They’re injectables, infusions, or special oral drugs that require handling and monitoring. Tier 4 usually means coinsurance-not a flat copay. That means you pay a percentage of the total cost. Think 25% to 33%. If your drug costs $5,000 a month, you’re paying $1,250 to $1,650. Tier 5 is even worse: 34% to 50%. Some specialty drugs cost over $10,000 a month. That’s $5,000 out of pocket. Examples: Humira for rheumatoid arthritis, Keytruda for melanoma, Spinraza for spinal muscular atrophy. These are miracle drugs. But they’re also financial nightmares. The good news? The Inflation Reduction Act of 2022 capped insulin at $35 a month for Medicare patients-no matter the tier. Some states are doing similar things for other drugs. And starting in 2024, Medicare’s new catastrophic coverage phase kicks in, which will lower costs for people hitting the high-tier spending cap.Non-Formulary: The No-Go Zone

This is the land where your drug isn’t covered at all. No copay. No coinsurance. Just full price. And that price? It can be astronomical. Drugs land here for a few reasons: They’re too new, too expensive, or there’s no clinical evidence they’re better than cheaper options. Sometimes, it’s just because the manufacturer didn’t negotiate with your insurer. Examples: A brand-name antibiotic that’s been around for 20 years but never got added to the formulary. Or a new migraine drug that costs $800 a month and your plan says, “We have two cheaper options.” If your drug is non-formulary, you have two choices: Pay full price, or get your doctor to file a formulary exception. Some plans will approve exceptions if you prove the drug is medically necessary and alternatives won’t work. But it’s not guaranteed.Why Do Tiers Change Without Warning?

You might fill your prescription for $30 one month, then get hit with $80 the next. That’s because formularies aren’t set in stone. Insurers can change them quarterly. And they often do. A drug might get moved up a tier if a cheaper generic becomes available. Or if the manufacturer stops offering rebates. Or if the insurer signs a new deal with another drugmaker. According to KFF, 43% of commercial plan members had at least one drug moved to a higher tier in 2022. And most got no notice. That’s why you should check your formulary every time you refill a prescription-especially if you’re on a chronic condition medication.How to Find Your Drug’s Tier

Don’t guess. Don’t ask the pharmacist. Don’t assume. Go straight to the source. 1. Log into your insurer’s website. Look for “Formulary” or “Drug List.”2. Search for your medication by name.

3. Check the tier and whether it’s a copay or coinsurance.

4. Look for alternatives in lower tiers.

Medicare beneficiaries can use the official Plan Finder tool at Medicare.gov. Commercial plan members can often use apps like GoodRx or Express Scripts’ Drug Cost Finder. These tools show you real-time pricing across pharmacies. Pro tip: Always ask your pharmacist, “Is this covered under my plan?” before you pay. They can check the formulary in real time and sometimes suggest a cheaper alternative on the spot.

What to Do If Your Drug Is Too Expensive

You’re not stuck. Here’s what works:- Ask for a generic. If one exists, switch to it. It’s almost always cheaper.

- Ask your doctor for a tier 1 or 2 alternative. Sometimes, a different drug in the same class works just as well.

- File a formulary exception. Your doctor writes a letter explaining why you need this drug and why others won’t work. Many plans approve these.

- Use patient assistance programs. Drugmakers often have discounts or free drug programs for low-income patients.

- Compare cash prices. Sometimes, paying cash at Walmart or Costco is cheaper than your insurance copay.

Why This System Is So Confusing

You’re not dumb. The system is broken. Only 32% of health plans explain why a drug is in a certain tier. The rest? They just list it. You have to dig through 100-page PDFs to find answers. A 2022 Harvard study found 61% of patients couldn’t predict their out-of-pocket cost before filling a prescription. That’s not transparency. That’s a gamble. And it’s not just you. A Patient Advocate Foundation survey showed 58% of people paid more than expected because their drug was in a higher tier than they thought. The truth? Formularies were designed to save money. But they’ve become a maze that punishes the people who need help the most.The Bigger Picture

The U.S. spends more on prescription drugs than any other country. Formularies are one reason why. They shift costs to patients. They create barriers. They force people to choose between medicine and rent. But they’re not going away. PBMs (Pharmacy Benefit Managers) like CVS Caremark and Express Scripts control 85% of formulary decisions. They negotiate rebates with drugmakers. And they get paid based on how much they save insurers. That’s why they push for more tiers and more restrictions. The only real solution? More transparency. Simpler tiers. And rules that stop insurers from changing formularies mid-year without notice. Until then, your best weapon is knowledge. Know your tier. Know your alternatives. Know your rights.What’s Changing in 2025?

By 2025, more plans will start using “value-based tiering.” That means drugs won’t just be ranked by price-they’ll be ranked by how well they work. A drug that keeps people out of the hospital might get moved to a lower tier, even if it’s expensive. Also, state drug affordability boards are starting to review formularies. California, Colorado, and Washington are already doing it. More states will follow. And Medicare’s new $2,000 out-of-pocket cap for Part D (starting in 2025) will change everything. People on high-tier drugs will finally get relief. But until then? Stay informed. Check your formulary. Ask questions. Don’t let your health be a game of chance.What is the difference between Tier 1 and Tier 2 drugs?

Tier 1 drugs are usually generic medications with the lowest out-of-pocket cost-often $0 to $15 for a 30-day supply. Tier 2 drugs are brand-name medications that your plan considers preferred, meaning they’re covered at a moderate cost, typically $20 to $40. Tier 2 drugs cost more because they’re not generics, but they’re still cheaper than non-preferred brands.

Why is my drug in Tier 3 when it’s cheaper than another drug in Tier 2?

Formulary tiers aren’t based on price alone. They’re based on negotiated rebates, clinical guidelines, and whether the insurer has a deal with the drugmaker. A drug might be cheaper than another, but if the manufacturer didn’t offer a rebate, it could still be placed in a higher tier. It’s not always logical-it’s business.

Can my insurance change my drug’s tier without telling me?

Yes. Insurers can change formulary tiers quarterly, and they’re not required to notify you before the change. That’s why you should check your formulary every time you refill a prescription. Many people are shocked when their $30 copay jumps to $90 because their drug was moved to a higher tier.

What does non-formulary mean for my prescription?

Non-formulary means your insurance won’t cover the drug at all. You’ll pay the full price out of pocket-sometimes hundreds or thousands of dollars. Your only options are to pay cash, ask your doctor for an alternative, or file a formulary exception request with your insurer.

How can I get a drug moved to a lower tier?

Your doctor can file a formulary exception request. They’ll need to explain why you need this specific drug and why alternatives won’t work. If approved, your plan will cover it at a lower tier. About 40% of these requests are approved, especially for chronic or serious conditions.

Are there tools to help me find the lowest cost for my medication?

Yes. Use GoodRx, SingleCare, or your plan’s drug cost finder tool. These show you cash prices and insurance copays at nearby pharmacies. Sometimes paying cash is cheaper than using your insurance, especially for Tier 3 or non-formulary drugs.

12 Comments

Alex Lopez

Let me just say this: if your insurance moves your Tier 2 drug to Tier 3 without notice, that’s not a business decision-it’s a betrayal wrapped in a PDF. I’ve had my diabetes med jump from $35 to $110 because some PBM broker got a better deal on a competing drug. No warning. No grace period. Just a receipt that made me cry in the pharmacy aisle. And don’t get me started on how they call this ‘cost containment.’ It’s cost shifting. And we’re the shifters.

Also, if you think generics are always the answer, try taking Metformin that’s been sitting in a warehouse for 18 months. Some of us need the brand because the generic gives us migraines. But hey, at least the formulary says it’s ‘clinically equivalent.’ Thanks, bureaucracy.

PS: GoodRx saved my life last year. Cash price at Costco was $12. Insurance copay? $87. The system is broken. But you can still win.

PPS: 😔

Liz Tanner

I used to be terrified of calling my doctor about my meds. I thought I’d sound like a nag. But once I asked, ‘Is there a Tier 1 alternative?’-they actually listened. My antidepressant switched from Tier 3 to Tier 2 just because I asked. Turns out, doctors want to help. They’re just buried in paperwork.

And if you’re scared to check your formulary? Start small. Look up one drug you take. Just one. You’ll be shocked how much you learn. It’s not your fault this system is confusing. It’s designed to be. But you’re not powerless.

Small steps. Big wins. You got this.

❤️

Babe Addict

Ugh. Tier 1? Tier 2? You’re all missing the point. This isn’t about tiers-it’s about PBM rent-seeking. Pharmacy Benefit Managers are middlemen who take 15-20% of drug rebates and don’t pass it on. They’re the reason your $20 generic costs $40 at the counter. They negotiate with manufacturers to create artificial scarcity so they can inflate tier structures. It’s a rigged game.

And don’t even get me started on ‘preferred brands.’ That’s just a fancy term for ‘we got paid to put this here.’ The whole tier system is a shell game designed to make you think you’re saving money while the real money flows to CVS Caremark and Express Scripts.

Real solution? Ban PBMs. Nationalize drug pricing. Done.

Also, if you’re using GoodRx, you’re already complicit in the system. Just saying.

Satyakki Bhattacharjee

People in America pay too much for medicine. In my country, medicine is cheap because we believe health is a right, not a product. You have a system where a man with cancer pays more than his car. This is not capitalism. This is cruelty.

Why do you let them do this? Because you are distracted by phones and TV. You do not fight. You just complain on Reddit.

Change begins with you. Not with a formulary. With your voice.

Wake up.

-Satyakki from India

John Barron

Look, I’ve been on 14 different insurance plans in the last decade. I’ve had drugs moved from Tier 1 to non-formulary on the same day I refilled. I’ve had my rheumatoid arthritis drug switched to a generic that gave me liver toxicity. I’ve had my cardiologist’s letter for a formulary exception ignored three times.

And yet, I still get told to ‘just ask for a generic.’ No. You don’t understand. Some of us aren’t lucky enough to have a body that tolerates the cheapest option. Some of us have autoimmune diseases that require precision. We’re not asking for luxury. We’re asking for survival.

And yes, I know GoodRx exists. But what if you’re on a $12,000/month infusion? GoodRx can’t help you. Only Medicare’s new $2,000 cap will. And even that’s too late for people who’ve already gone bankrupt.

So please. Stop saying ‘just check your formulary.’ That’s not advice. That’s victim-blaming with a side of corporate jargon.

And yes, I’m still alive. But I’m tired. 😔

dean du plessis

My cousin in South Africa pays $2 for her blood pressure med. No tier system. No forms. No waiting. Just walk in, pay, walk out.

Here you got a whole essay on why your pill costs $90. I just shake my head.

People are smart. You know what you need. You just need someone to listen.

Not a formulary. Not a rebate. Just someone who cares.

Still breathing. Still taking pills.

-Dean

Andrew Gurung

Oh honey. You think this is bad? Wait until you’re on a Tier 5 drug and your insurance says ‘we’ll cover 50%’-but only if you use their mail-order pharmacy, which takes 14 business days to ship, and your prescription expires in 10.

And don’t even get me started on the ‘prior authorization’ form. It’s a 17-page PDF with 42 checkboxes, three notarized signatures, and a doctor who charges $300 to fill it out.

Meanwhile, the CEO of the insurer just bought a private island. Coincidence? I think not.

Also, I’m not mad. I’m just disappointed. 😔💔

And yes, I cried watching a documentary about insulin pricing last night. Don’t judge me.

Paula Alencar

Let me tell you something that no one else will: the formulary system is not broken. It is functioning exactly as designed. It was never meant to serve patients. It was built to serve shareholders. To maximize rebates. To shift financial risk onto the most vulnerable.

I’ve spent 18 years as a pharmacist in rural Ohio. I’ve watched mothers choose between insulin and groceries. I’ve seen elderly men skip doses so they can afford their wife’s heart medication. I’ve held the hands of people who cried because their Tier 3 drug was moved to non-formulary-on the same day their husband passed away.

And every time I say something, I’m told, ‘That’s just how the system works.’

No. It’s not. It’s evil. And we are all complicit by doing nothing.

So yes. Check your formulary. But also call your senator. Write to your insurer. Demand transparency. Demand justice. Because if we don’t, the next person who cries in the pharmacy aisle? It might be you.

And I’ll be here. Watching. Waiting. Holding space for your grief.

With love, always.

-Paula

Liz MENDOZA

Thank you for this. I needed to read this. My mom just got her first formulary change notice and she didn’t understand why her blood thinner went from $15 to $80. She thought it was her fault. I showed her how to check the drug list. We found a generic that’s in Tier 1. She cried. Not from sadness-from relief.

You’re not alone. And you’re not crazy for being angry. This system is designed to make you feel powerless. But you’re not. You’re just tired.

I’m here if you need to vent. Or if you just need someone to say, ‘That’s not fair.’

💙

Nikki Thames

Let me be the one to say it: if you’re still using a Tier 3 drug in 2025 and haven’t filed for a formulary exception, you’re not being proactive-you’re being negligent. Your doctor isn’t doing their job if they didn’t push for alternatives. And if you didn’t research cash prices on GoodRx? You’re just letting the system win.

Also, the fact that you think ‘non-formulary’ is some mysterious black hole? It’s not. It’s just a business decision. You’re not special. You’re not a victim. You’re just someone who didn’t do the homework.

And don’t get me started on the people who say ‘I can’t afford to check my formulary.’ You can’t afford not to. This isn’t a luxury. It’s survival.

Stop waiting for someone to fix it. Fix it yourself. Or don’t complain.

-Nikki

Gerald Tardif

Hey. I see you. I’ve been there. I’ve been the one holding the $120 receipt, wondering if I should just throw it away and walk out.

But here’s the thing: you’re not weak for needing this medicine. You’re strong for still showing up.

And if you’ve checked your formulary, called your doctor, tried GoodRx, and still got crushed? That’s not your failure. That’s the system’s.

Keep going. One pill at a time.

You’re not alone.

-Gerald

Alex Lopez

Wait. I just saw Nikki’s comment. You know what? She’s right. I didn’t file for an exception on my Tier 3 drug for six months. I thought it was too much work. Turns out, it took 12 minutes to submit. And it was approved.

So yeah. I was wrong. I let fear stop me. But I’m changing that.

Thanks for calling me out, Nikki. I needed that.

Also, I just sent an email to my state rep. And I’m not stopping.

-Alex