When it comes to saving money on life-changing biologic drugs, biosimilars are the quiet revolution most people don’t know about. These aren’t generic pills you pick up at the corner pharmacy. They’re complex, living-molecule medicines-like those used for rheumatoid arthritis, cancer, and diabetes-that mimic expensive brand-name biologics with near-identical results. But here’s the catch: Europe has been using them for nearly two decades. The United States only started catching up in the last five years. Why? It’s not about science. It’s about rules, money, and who gets to decide.

Europe Got a Head Start-And Never Looked Back

Europe didn’t wait for permission. In 2006, the European Medicines Agency (EMA) approved the world’s first biosimilar, Omnitrope, a version of the growth hormone somatropin. That was the beginning of a structured, science-first approach. The EMA didn’t demand endless new clinical trials. Instead, they looked at the full picture: how the molecule was made, how it behaved in the lab, and whether it acted the same way in patients as the original. If the data added up, approval followed. No extra hoops.

By 2024, Europe’s biosimilar market hit $13.16 billion in revenue, according to Precedence Research. Germany, France, and the UK led the charge. Hospitals there didn’t just accept biosimilars-they actively chose them. Why? Because procurement systems rewarded cost savings. Tenders favored lower prices. Doctors were trained early. Patients were told the science was solid. In some countries, biosimilars now make up over 80% of the market for drugs like infliximab and rituximab used in autoimmune diseases.

The system worked because it was simple: EMA approves, countries negotiate prices, and hospitals buy. No legal battles. No patent dances. Just clear rules and real savings.

The US Started Late-And Got Stuck

The United States passed the Biologics Price Competition and Innovation Act (BPCIA) in 2009. Sounds promising, right? But it took six years for the first biosimilar, Zarxio, to hit the market in 2015. Why the delay? Because the rules were tangled.

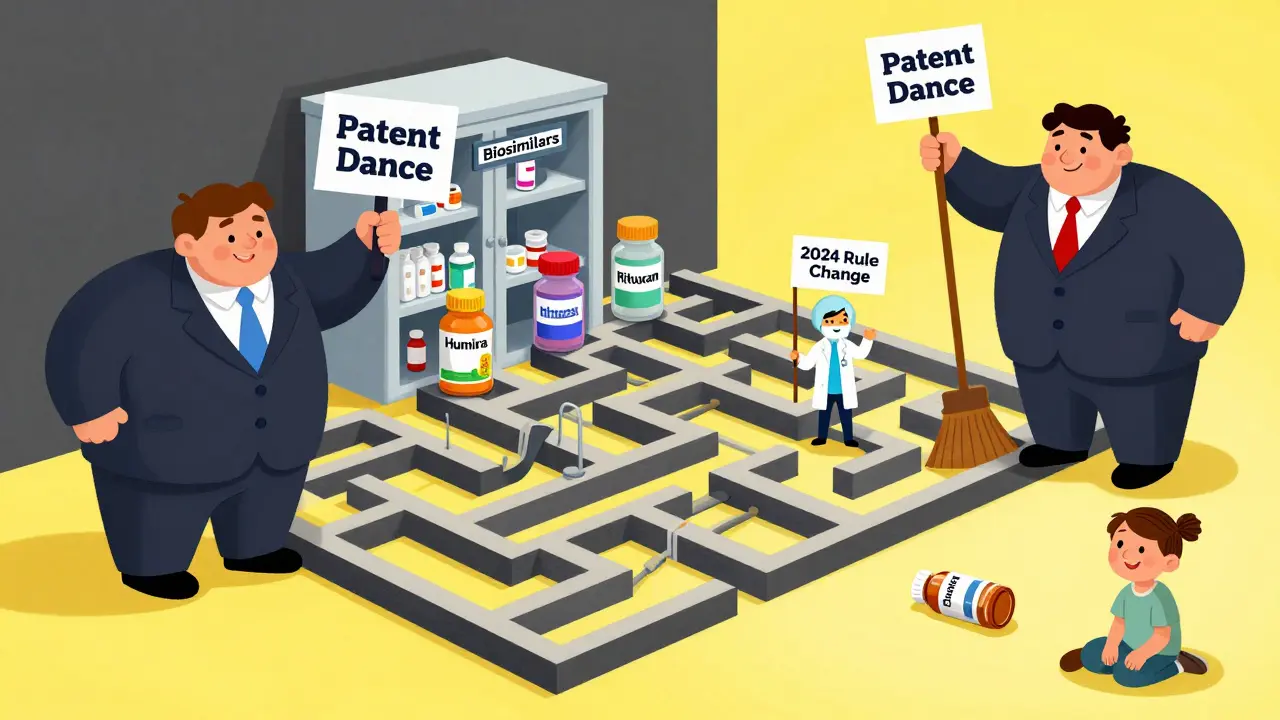

Big pharma didn’t sit back. They used patents like weapons. Legal fights over patent rights-called the “patent dance”-delayed market entry for years. Even when a biosimilar was approved, companies would settle with originators to delay launch. By 2024, the FDA had approved over 20 biosimilars, but only about a dozen were actually available. For example, Humira, the best-selling drug in history, had 14 biosimilars approved-but only six were on the market because of patent deals.

Then there was the interchangeability problem. To be labeled “interchangeable”-meaning a pharmacist could swap it for the brand without asking the doctor-US regulators demanded extra clinical studies. These “switching studies” forced companies to prove patients could safely jump back and forth between the brand and biosimilar. Europe never required this. The FDA finally dropped this requirement in June 2024, aligning more closely with Europe’s approach. But the damage was done. Years of delay had built deep skepticism among doctors and patients.

Costs Are Lower-But Adoption Is Slower

Biosimilars typically launch at 15% to 30% less than the original biologic. In Europe, that discount became the new normal. In the US, discounts often stayed closer to 10% to 15%, especially early on. Why? Because payers-insurance companies and Medicare-were slow to change formularies. Doctors didn’t switch unless they were pushed. And many didn’t trust the data.

But that’s changing. The Inflation Reduction Act of 2022 removed the Medicare Part D coverage gap, which meant seniors no longer paid more out-of-pocket as they used more drugs. Suddenly, biosimilars became financially attractive. Hospitals and insurers started pushing them harder. In 2024, the US biosimilar market hit $10.9 billion, growing at an 11% annual rate since 2020. That’s fast-but still behind Europe’s pace.

And here’s the irony: the US has more high-revenue biologics coming off patent. IQVIA estimates $232 billion in biologic sales will face biosimilar competition between 2025 and 2034. Europe has fewer big-ticket drugs left to go. So while Europe’s market is more mature, the US has a bigger runway ahead.

Who’s Making Them? Where’s the Manufacturing?

Europe didn’t just approve biosimilars-it built an industry. Germany became a global hub for biosimilar manufacturing. Companies like Sandoz (Novartis), Fresenius Kabi, and Amgen set up production lines there because the regulatory path was clear and the talent was strong. Today, Europe produces more biosimilars than any other region.

The US market is catching up fast. Pfizer, Merck, and Samsung Bioepis are now major players. But manufacturing remains a challenge. Biosimilars aren’t pills you can mass-produce. They’re made from living cells, grown in bioreactors, and require extreme precision. One tiny change in temperature or nutrient mix can alter the final product. That’s why companies with deep biotech experience-like those in Europe-still lead in production quality and scale.

Therapeutic Areas: Where the Battle Is Won

In Europe, biosimilars dominate in oncology and autoimmune diseases. Drugs like adalimumab (Humira), etanercept (Enbrel), and bevacizumab (Avastin) are now mostly biosimilar. Patients get the same outcome at a fraction of the cost.

The US started differently. The first biosimilars were supportive care drugs-like filgrastim (used to boost white blood cells after chemo). These were simpler to replicate and had fewer legal barriers. But now, the US is moving fast into complex areas. Humira biosimilars are finally launching. Cancer drugs like trastuzumab (Herceptin) and rituximab (Rituxan) are next. The FDA’s 2024 rule change will accelerate this shift.

What’s Next? Convergence, Not Competition

The gap between Europe and the US is closing. The FDA’s removal of the switching study requirement was a game-changer. It signals a shift toward the European model: trust the science, reduce barriers, let competition work.

Europe isn’t standing still. They’re now tackling next-generation biologics-like bispecific antibodies and cell therapies-that are even harder to copy. The US is learning from Europe’s playbook: clear rules, early education, payer incentives, and manufacturer collaboration.

By 2030, the global biosimilar market could hit $175 billion. Europe will still be a leader, but the US is on track to overtake it in total revenue by 2027, according to Grand View Research. The real winner? Patients. More access. Lower prices. Better outcomes.

The lesson? Regulation shapes markets more than technology. Europe showed how to do it right. The US is finally learning.

What’s the difference between a biosimilar and a generic drug?

Generics are exact chemical copies of small-molecule drugs, like aspirin or metformin. Biosimilars are copies of large, complex biologic drugs made from living cells-like antibodies or proteins. You can’t make an exact copy because living systems vary slightly. So biosimilars are “highly similar,” not identical, but proven to work the same way with no meaningful difference in safety or effectiveness.

Why are biosimilars cheaper than the original biologics?

Original biologics cost billions to develop because they require years of research, complex manufacturing, and extensive clinical trials. Biosimilar makers don’t need to repeat all that. They use the original drug’s data to prove similarity, cutting development time and cost by 60-70%. That savings gets passed on as lower prices-usually 15% to 30% off.

Are biosimilars safe?

Yes. Every biosimilar approved by the EMA or FDA has gone through the same rigorous testing as the original. They’re tested for purity, potency, and how they behave in the body. Millions of patients in Europe have used them for nearly 20 years with no new safety concerns. The FDA requires the same level of proof before approval.

Why did the US take so long to adopt biosimilars?

Three main reasons: legal battles over patents, unclear reimbursement rules, and the FDA’s original requirement for costly switching studies. Big pharma used patent lawsuits to delay entry. Insurers didn’t push biosimilars because they weren’t sure how to pay for them. And doctors were hesitant without real-world experience. The 2024 FDA rule change removed the biggest barrier.

Will biosimilars replace original biologics completely?

Not completely, but they’ll dominate. In Europe, some drugs are now 80-90% biosimilar. In the US, adoption is rising fast. Original manufacturers may keep a small share for patients who switched and did well on the brand, or for those with rare side effects. But cost pressure, payer policies, and physician confidence are pushing most toward biosimilars.

Which countries in Europe lead in biosimilar use?

Germany, France, the UK, and Scandinavia lead in adoption. Germany is also the biggest manufacturing hub. These countries have centralized hospital procurement systems that prioritize cost savings. They also run public education campaigns to build trust among doctors and patients.

What’s the biggest challenge for biosimilars today?

Manufacturing complexity. As biologics get more advanced-like bispecific antibodies or gene therapies-it’s harder to copy them. Regulatory agencies are still figuring out how to evaluate these next-generation molecules. Education is also key: many doctors still don’t fully understand biosimilars, and patients worry about switching. But the data is clear: they work.

9 Comments

Anjula Jyala

Biosimilars aren't even close to generics the molecular complexity alone makes this a whole different regulatory beast EMA's framework is elegantly minimalistic while the FDA's patent dance is just corporate rent-seeking dressed as IP protection

Kirstin Santiago

It's interesting how Europe built trust through transparency and education while the US let legal battles and hesitation slow things down. Doctors need clear guidance and patients need reassurance - it's not just about approval, it's about adoption.

Marian Gilan

you think this is about science? lol the FDA is just a puppet for big pharma. they delay biosimilars so the big boys can keep raking in billions. watch how fast they change the rules when the public starts asking why their insulin costs 300 bucks

John O'Brien

Europe didn't just approve biosimilars - they forced hospitals to use them. Meanwhile in the US, insurers still pay more for the brand because they're scared of lawsuits. This isn't about science, it's about who controls the cash flow. Time to cut the middlemen.

Andrew Clausen

The assertion that the FDA's switching study requirement was the primary barrier is misleading. While it was a factor, the real issue was market inertia and payer reluctance. Regulatory alignment alone doesn't drive adoption - economic incentives and clinical confidence do. The 2024 change was symbolic, not transformative.

Conor Flannelly

There's something poetic about Europe leading this. They've always treated healthcare as a public good, not a profit center. The US is catching up, but slowly - like someone learning to ride a bike after decades of driving a car. The science is there. The will? That's the real challenge.

Conor Murphy

I've seen patients switch from Humira to a biosimilar and not even notice the difference. It's not magic - it's science. But we still have to fight the fear. Maybe we need more stories from real people, not just data. ❤️

Desaundrea Morton-Pusey

Europe gets to play hero while the US pays the price. Typical. We're the ones funding all the R&D and then they steal our drugs and sell them cheaper. Wake up, America - this isn't globalization, it's exploitation.

Murphy Game

They're lying about the cost savings. Biosimilars are cheaper on paper, but the real cost is in the hidden complications - adverse events, liability, and long-term monitoring. The FDA knew this. They didn't rush because they care about patients. The rest of you just want cheaper drugs, not safer ones.