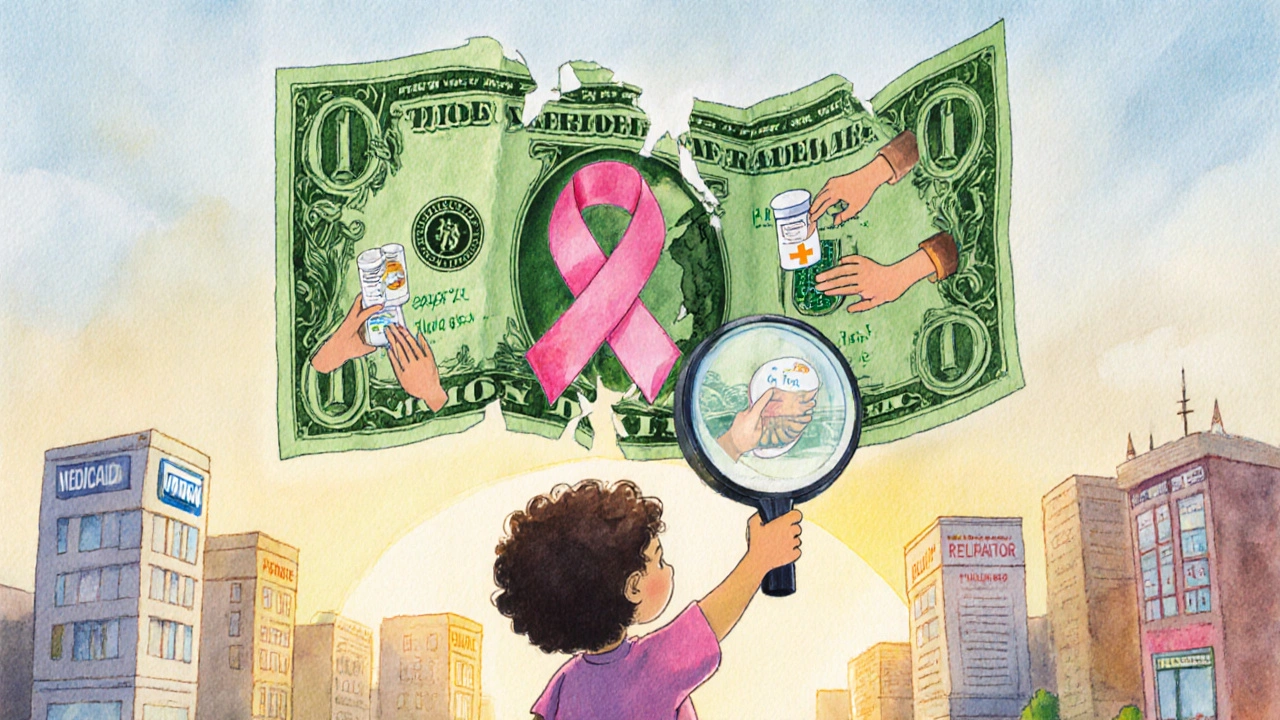

When you’re fighting cancer, the last thing you should worry about is how to pay for treatment. But for too many people, the cost of surviving cancer becomes a second illness - one that doesn’t show up on scans but can destroy savings, relationships, and even survival chances. This is financial toxicity: the crushing weight of medical bills, lost income, and daily choices between medicine and rent. It’s not just a problem in the U.S. - it’s a global crisis hiding in plain sight.

What Financial Toxicity Really Means

Financial toxicity isn’t just about big hospital bills. It’s the daily stress of choosing between filling a prescription and buying groceries. It’s the parent who skips chemotherapy doses because they can’t afford the copay. It’s the spouse who quits their job to drive their partner to treatments - and then loses their own health insurance. The term was first used by researchers at Duke University in 2013, and since then, studies have shown it affects between 28% and 73% of cancer patients, depending on how it’s measured.Unlike side effects like nausea or fatigue, financial toxicity doesn’t fade after treatment ends. Many survivors face ongoing costs for follow-up scans, medications for long-term side effects, or even mental health care. A 2021 study found that nearly half of cancer survivors still struggle with financial stress years after diagnosis. For low-income women with breast cancer, treatment costs can eat up 98% of their annual income. That’s not a statistic - that’s a life derailed.

Why Cancer Treatment Costs Keep Rising

Cancer care has become one of the most expensive areas of medicine. New treatments like immunotherapy and targeted therapies can cost over $10,000 a month - and sometimes need to be taken for years. These drugs are life-saving, but they’re also priced like luxury goods, not essential medicine. Even patients with insurance aren’t safe. High-deductible plans, copays, and coinsurance have climbed sharply over the last decade. Many people don’t realize their insurance might cover only 60% of a drug’s cost - leaving them with a $5,000 monthly bill.Out-of-pocket expenses include more than just drugs. Travel to distant cancer centers, parking fees, childcare during appointments, and time off work add up fast. One study found that 13% of non-elderly cancer patients spend at least 20% of their income just on out-of-pocket medical costs. For Medicare beneficiaries, half spend more than 10% of their income on cancer care. That’s more than most people spend on housing.

Who Gets Hit the Hardest

Financial toxicity doesn’t affect everyone equally. Younger patients - under 65 - are especially vulnerable. They’re more likely to be in the workforce, have dependents, and lack savings. Older patients often have Medicare and fixed incomes, which, while not ideal, offer more predictable coverage. Younger patients with high-deductible plans or job-based insurance face the worst of both worlds: expensive treatments and unstable coverage.People with metastatic cancer face even greater financial pressure. Their treatment doesn’t end after six months - it lasts for years. Immunotherapy for advanced lung or melanoma cancer can cost over $150,000 a year. Even with insurance, copays can hit $10,000 annually. And if you lose your job because you can’t work? That insurance vanishes.

Low-income communities, especially communities of color, are hit hardest. Studies show they’re less likely to have access to financial navigation services, less likely to qualify for pharmaceutical assistance programs due to paperwork barriers, and more likely to delay or skip care because of cost. The result? Higher death rates from cancers that are treatable if caught early and managed properly.

How Financial Toxicity Hurts Your Health

This isn’t just about money - it’s about survival. Patients who report financial distress are more likely to:- Skip or cut doses of chemotherapy or targeted drugs

- Delay or refuse imaging scans and follow-up appointments

- Stop taking pain medications because they’re too expensive

- Report higher levels of depression, anxiety, and fatigue

- Have worse overall survival rates

One patient told researchers she chose between buying insulin for her diabetes and her cancer drug. She picked the insulin. She died six months later. That’s not an isolated story. A 2020 survey found that 78% of oncologists said patients had skipped or changed treatment because of cost. That’s not a side effect - that’s a system failure.

And it’s not just the patient. Spouses and caregivers report high levels of stress, depression, and financial strain. One study of patients in early-phase clinical trials found that 82% worried about medical costs, and 79% felt financial stress. These aren’t numbers - these are real people living in fear every day.

What You Can Do: Practical Steps to Reduce the Burden

You don’t have to face this alone. There are real ways to reduce the financial burden - if you know where to look.- Ask for a financial navigator. Most major cancer centers now have financial navigators - free counselors who help you understand bills, find assistance programs, and apply for aid. Don’t wait until you get a bill you can’t pay. Ask on your first visit.

- Check for patient assistance programs. Drug manufacturers offer free or discounted medicines to eligible patients. Programs like the Patient Advocate Foundation’s Co-Pay Relief Program gave over $327 million in help to 67,000 cancer patients in 2022 alone. You don’t need to be poor - many programs accept people with insurance but high copays.

- Apply for Medicaid or state programs. Even if you thought you didn’t qualify, rules change. Some states now allow higher income limits for cancer patients. Call your state’s Medicaid office or visit HealthCare.gov.

- Request a payment plan. Hospitals often have hardship programs. Don’t be afraid to ask. Many will reduce bills by 50% or more if you show financial need.

- Use the COST tool. This simple 10-question survey helps doctors spot financial distress early. Ask your oncologist to use it. If they don’t know what it is, bring a printed copy. It’s backed by the American Society of Clinical Oncology.

What’s Changing - And What’s Coming

Change is happening, slowly. In 2022, California passed a law requiring drugmakers to justify price hikes for cancer drugs. Other states are following. The U.S. House reintroduced the Cancer Drug Parity Act in 2023 - a bill that would force insurers to charge the same copay for oral drugs (taken at home) as they do for IV treatments (given in clinics). Right now, oral drugs often cost 10 times more out-of-pocket - a huge burden for patients who can’t travel to clinics.AI is also stepping in. A 2023 study showed an algorithm could predict which patients were at high risk for financial toxicity with 82% accuracy by looking at their income, insurance, location, and treatment plan. Hospitals using this tool can now reach out before the crisis hits - offering help before bills pile up.

The National Comprehensive Cancer Network now includes financial toxicity screening in its official survivorship guidelines. By 2025, experts predict 75% of NCI-designated cancer centers will have formal screening programs - up from just 35% in 2022. That’s progress.

The Bottom Line: You’re Not Alone

Cancer is hard enough. You shouldn’t have to choose between your health and your home. Financial toxicity is not your fault. It’s a broken system. But there are people and programs ready to help - if you know how to ask.Start today. Call your oncology clinic and ask: “Do you have a financial navigator?” If they say no, ask for the name of the patient advocacy group they work with. Write down every bill. Keep a notebook of all your expenses - even small ones. You might be surprised how much you can recover with the right help.

You’re not just fighting cancer. You’re fighting a system that’s designed to profit from illness. But you’re not powerless. Knowledge is your next treatment. Use it.

What is financial toxicity in cancer care?

Financial toxicity is the severe financial stress and hardship caused by the cost of cancer treatment. It includes out-of-pocket expenses like copays, medications, and travel, as well as lost income and emotional distress. It’s not just about going broke - it’s about choosing between medicine and rent, treatment and food. The term was first defined in 2013 and is now recognized by the National Cancer Institute as a major threat to cancer care access.

How common is financial toxicity among cancer patients?

Studies show between 28% and 73% of cancer patients experience financial toxicity, depending on how it’s measured. Objective data shows 13% of non-elderly patients spend at least 20% of their income on cancer care. For Medicare beneficiaries, half spend more than 10% of their income on out-of-pocket costs. Low-income women with breast cancer may spend up to 98% of their annual income on treatment.

Can financial toxicity affect cancer survival?

Yes. Patients who report financial distress are more likely to skip doses, delay scans, or stop treatment entirely. Research links financial toxicity to worse survival rates, higher depression, and increased anxiety. One study found patients considered financial stress more severe than physical or emotional side effects. When you can’t afford your medicine, survival becomes a gamble.

What help is available for cancer patients struggling with costs?

Many options exist: financial navigators at cancer centers, drug manufacturer assistance programs, state Medicaid expansions, hospital charity care, and nonprofit co-pay relief funds. In 2022 alone, the Patient Advocate Foundation provided $327 million in aid to 67,000 cancer patients. Ask your oncology team for help - they’re required to connect you with resources.

What should I do if I can’t afford my cancer treatment?

Don’t stop treatment without talking to your care team. Ask for a financial navigator, apply for patient assistance programs, request a payment plan, and check if you qualify for Medicaid. Keep records of all expenses. Use the COST tool to help your doctor identify your risk. Many programs have hidden eligibility - you don’t need to be poor to qualify. Help is available, but you have to ask.

14 Comments

Peter Lubem Ause

Financial toxicity is real, and it’s not just a US problem. I’ve seen friends in Lagos skip chemo because they couldn’t afford the transport to the hospital, let alone the meds. No one talks about this enough. It’s not about being poor-it’s about systems that treat survival like a luxury. You don’t need a PhD to know that if you’re choosing between insulin and cancer drugs, the system is broken. Period.

But here’s the thing: help exists. Ask for it. Don’t wait until you’re drowning. Financial navigators? They’re free. Patient assistance programs? They’re not secret. You just have to be stubborn enough to ask. And if they say no? Ask again. And again. Your life is worth the hassle.

linda wood

So let me get this straight-you’re telling me a person with cancer has to fill out 17 forms just to get a $500 copay discount, but Big Pharma can raise prices 300% overnight and call it ‘innovation’? Cute.

I’m not mad. I’m just disappointed. And honestly? I’m tired of hearing ‘just ask for help’ like it’s that easy. What if you’re too sick to make calls? What if you don’t speak English? What if you’re undocumented? The system isn’t broken-it’s designed this way.

LINDA PUSPITASARI

Y’all need to know about this 🤯

I work in oncology admin and I’ve seen it all. A mom with stage 4 breast cancer had to sell her car to pay for her oral chemo. Her kid got a new backpack with the money from the sale. She cried when she told me. I cried when I wrote her check.

But here’s the good part-she applied for Co-Pay Relief through PAF and got $12k covered. No one told her it existed. No one. So if you’re reading this and you’re scared? Stop. Go to patientadvocate.org right now. Don’t wait. Just do it.

Also-ask your oncologist for the COST tool. If they don’t know what it is, print it out and hand it to them. It’s literally 10 questions. You’re not being annoying-you’re saving your life.

stephen idiado

Financial toxicity? More like financial incompetence. If you can’t afford treatment, you shouldn’t have had kids. Or bought a house. Or taken a job without insurance. This isn’t a systemic failure-it’s a personal one. People need to plan. Stop expecting society to bail you out.

Andrew Keh

I think we all agree that no one should have to choose between medicine and rent. But the solutions aren’t simple. Some of the programs mentioned are great, but they’re underfunded and understaffed. Maybe we need to stop putting the burden on patients to navigate bureaucracy and start demanding policy change. Hospitals, insurers, and drugmakers all profit from this system. They should be held accountable-not the patients.

Latika Gupta

Wait… so you’re saying people in Nigeria and India have the same problems? But I thought this was just an American thing… I feel like I’ve been lied to. Also, do you think this affects people who don’t have smartphones? Like, how do they find these programs? I’m just curious.

Sohini Majumder

OMG I CANNOT BELIEVE THIS IS STILL A THING??? Like… are we living in 1923?? I mean, I had to pay $200 for a Band-Aid last year and I didn’t even have cancer?? 😭 This is literally a horror movie and we’re all just sitting here like… ‘well at least my dog has health insurance’??

tushar makwana

i understand the pain. i come from a small village in india where my cousin had to walk 30km to get a scan because the nearest hospital charged too much. she survived. but many didn’t. we need to talk about this more. not just in rich countries. the silence is killing us.

Matthew Higgins

Bro. I had a friend who got diagnosed with lymphoma. Insurance said no to the drug. He got a GoFundMe. Raised $40k in 3 weeks. People donated pizza. One guy sent him a handwritten letter saying ‘you’re a warrior’. He cried for an hour. Then he went back to chemo.

That’s not healthcare. That’s a crowdfunding circus. And it’s messed up.

Mary Kate Powers

One thing I’ve learned from working with survivors: the earlier you talk about money, the better. Don’t wait for the bill to arrive. Ask for help on day one. Financial navigators aren’t just for ‘poor’ people-they’re for anyone who doesn’t want to lose everything. You don’t need to be broke to qualify for help. Just brave enough to ask.

Sara Shumaker

There’s a philosophical layer here that rarely gets discussed: if survival is tied to income, then we’ve commodified life itself. Cancer isn’t a disease we’re treating-it’s a market segment we’re monetizing. The fact that we accept this as normal says more about our values than it does about healthcare policy. We’ve normalized suffering as a cost of doing business. And that’s the real toxicity.

Scott Collard

Let’s be real: if you can’t afford cancer treatment, you shouldn’t have gotten cancer. That’s just biology. The system isn’t designed to subsidize bad life choices. Maybe focus on prevention instead of asking for handouts.

Steven Howell

It is my professional opinion that the current paradigm of oncologic financial support is fragmented, inefficient, and insufficiently standardized across institutional and geographic boundaries. The absence of a unified, federally mandated financial toxicity screening protocol represents a critical gap in the continuum of cancer care delivery. Evidence-based interventions must be institutionalized, not left to the discretion of individual patient advocacy.

Robert Bashaw

I’m not crying. You’re crying. I just watched a documentary where a woman sold her wedding ring to pay for a single dose of immunotherapy. And the drug company’s CEO? Bought a private island. With a waterfall shaped like a heart. And he named it ‘Hope’.

That’s not capitalism. That’s a damn horror show. And we’re all just watching the credits roll.